Arizona Hits the Accelerator

Arizona’s fourth quarter 2018 economic outlook update

With accelerating gains, the Arizona economy is set to carry significant momentum into the new year. State job growth hit 3.0% over the year in the third quarter, which was well above the national rate of 1.7% and was the fastest pace in two years. Construction activity led growth, with strong increases in jobs, permits, and prices. While most job gains were concentrated in Phoenix, Tucson generated rapid growth as well. Overall, the state is firing on all cylinders.

The baseline forecast calls for the U.S., Arizona, Phoenix, and Tucson economies to accelerate in the near term, driven in part by federal tax cuts and increased federal spending. However, as the stimulus wears off growth is expected to slow. Recession risks are ever present, but are most likely to come to the fore in late 2019.

Arizona Recent Developments

Job growth in Arizona picked up steam in the third quarter, with the state adding 81,500 jobs over the year, according to preliminary estimates. That translated into 3.0% growth, which far outstripped the national rate of 1.7%, and was the fastest pace since the third quarter of 2016. The Phoenix Metropolitan Statistical Area (MSA) added 72,400 jobs over the year, for 3.6% growth, while the Tucson MSA added 8,900 jobs, for 2.4% growth.

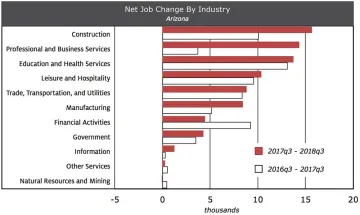

As Exhibit 1 shows, construction employment added the most jobs over the year in the third quarter, with 15,700. However, growth was solid across most sectors in Arizona. Indeed, professional and business services; education and health services; leisure and hospitality; trade, transportation, and utilities; and manufacturing each added well in excess of 5,000 jobs over the year.

Job gains generated during the past year far outpaced gains during the third quarter 2016 to third quarter 2017 period, when Arizona added 63,900 jobs for 2.4% growth. As the exhibit shows, the state generated a significant acceleration in job gains in construction; professional and business services; and manufacturing. Gains have slowed in financial activities.

Exhibit 1: Arizona Job Gains Accelerated During The Past Year

Construction jobs rose at a blistering pace during the third quarter of 2018, up 10.6% over the year. In part, that reflected continued gains in housing construction activity. Year to date through September, statewide housing permits rose 10.6% over 2017. That was driven by gains in single family (up 11.6%) and multi-family (up 8.2%) activity.

Arizona house prices continued to rise at a rapid clip in the second quarter of 2018, far outpacing income gains. Statewide house prices, measured by the Federal Housing Finance Agency, rose 8.8% over the year. That beat the nation at 6.6%. Overall, housing affordability continues to decline, but is probably not yet in the red zone.

Arizona’s merchandise exports to the world are on the rise once again. Year to date through August, state exports increased 7.2% over 2017. However, exports to Mexico and Canada were down, by 1.3% and 1.5%, respectively. In contrast, Arizona’s exports to Asia, Europe, and South/Central America were up 10.5%, 11.0%, and 68.5%, respectively. While the U.S. dollar remains elevated against most currencies (including the Mexican peso and Canadian dollar), the impact of the dollar appreciation should be dissipating at this point. On that score at least, the signs point to stronger export performance going forward.

Arizona Outlook

The October U.S. outlook from IHS Markit calls for real GDP growth to accelerate in 2018 to 2.9%, from 2.2% last year. Gains then decelerate to 2.8% in 2019 and then to 2.0% in 2020 and 1.6% in 2021. Overall, growth is strong in the near term, driven in part by federal tax cuts and increased spending, but that is followed by slower growth as the stimulus wears off and demographic forces (aging of the baby boom generation) reassert themselves.

Monetary policy is expected to continue on the current path toward higher interest rates. The federal funds rate, a key overnight interest rate targeted by the Federal Reserve, is expected to rise from 1.82% this year to 3.43% by 2022. That is expected to drive the 30-year conventional mortgage rate up from 4.55% this year to 5.24% by 2022.

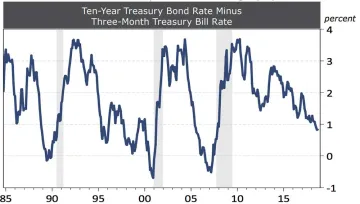

With interest rates on the way up, now is a good time to pay more attention to financial indicators of macroeconomic performance, particularly the yield curve (which highlights interest rate spreads by maturity). The difference between the 10-year Treasury bond rate and the three-month Treasury bill rate is one commonly used indicator of the interest rate spread. Since long-term interest rates are normally higher than short-term rates, the difference is usually positive, as Exhibit 2 shows.

Exhibit 2: The U.S. Interest Rate Spread Has Been Falling Rapidly

Note from the exhibit that when the interest rate spread has turned negative, it has tended to happen just before a recession (recessions are the shaded areas on the exhibit). While the spread is still positive (at 0.8 percentage points), it has declined significantly and is at its lowest level since late 2007. This will be an indicator to keep a close eye on as the Federal Reserve continues to reduce monetary policy accommodation.

Rising interest rates contribute to slower gains in residential investment, but are not forecast to generate a decline in housing starts. Indeed, the forecast calls for starts to rise from 1.27 million this year to 1.44 million by 2022.

The U.S. outlook puts a firm foundation under the Arizona forecast, as Exhibit 6 shows. The forecast calls for job growth in Arizona to accelerate from 2.6% last year to 2.9% in 2018, then to slow to 2.7% in 2019, and again in 2020 to 2.2%.

Most of the job growth is forecast to be in service-providing sectors, especially education and health services; professional and business services; trade, transportation, and utilities; and leisure and hospitality. Those four sectors alone are forecast to generate 68.9% of state job gains through 2020. However, all sectors add jobs during the next two years, including financial activities; construction; government; manufacturing; other services; information; and mining.

Housing permits are forecast to rise during the forecast, hitting 43,812 by 2020, as population gains more than offset the impact of higher interest rates.

Rapid job gains this year will contribute to solid personal income growth of 5.5% in 2018, followed by stronger gains in 2019-2020, of 6.4% and 6.3%, respectively. Income gains pick more steam as tightening labor markets put upward pressure on wages.

Higher personal income translates into solid improvement in taxable retail sales during the forecast.

Rising jobs contribute to solid net migration inflows, which, when combined with positive natural increase, generate population growth of 1.7% in 2018, followed by rates of 1.6% in 2019 and 2020.

Overall, Arizona is forecast to outpace the nation in all major macroeconomic indicators. However, gains remain well below average rates posted before the Great Recession.

Exhibit 3: Arizona Outlook Summary