Steady as She Goes: Arizona Wage Gains Improve

After faltering to just 1.2% in 2016, growth in Arizona wages per worker improved to 3.3% in 2017.

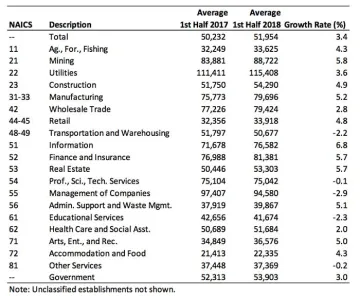

Arizona wages gains have struggled to find firm footing since the end of the Great Recession. Exhibit 1 shows the smoothed, over-the-year growth rate in Arizona wages per worker (using Quarterly Census of Employment and Wages (QCEW) data). Note that even though wages have steadily improved during the recovery, gains have been well below the pace posted before the recession. Overall, growth in wages per worker averaged 2.1% per year from 2010 to 2017, slightly above the corresponding U.S. consumer price inflation rate of 1.7%

Exhibit 1: Growth In Arizona Wages Per Worker, Four-Quarter Moving Average, QCEW

After faltering to just 1.2% in 2016, growth in Arizona wages per worker improved to 3.3% in 2017, which was the fastest pace since 2007. That momentum was maintained into 2018. Through the first six months of the year, wages increased 3.4% compared to the same period in 2017.

While all major sectors generated wage gains in 2017, growth rates varied significantly. Exhibit 2 shows wage growth by NAICS supersector. Other services, natural resources and mining, leisure and hospitality, and construction generated the fastest gains. Manufacturing, financial activities, government, and information grew relatively slowly.

Exhibit 2: Arizona Wages Per Worker By NAICS Supersector, QCEW

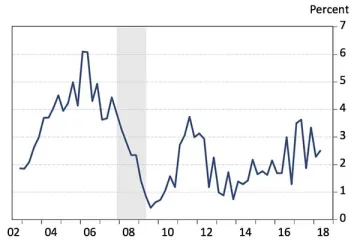

Exhibit 3 provides additional detail by the breaking data out into two-digit NAICS industries. Wage growth was most rapid for management of companies; other services; agriculture, forestry, and fishing; accommodation and food; and construction. Manufacturing; professional, scientific, and technical services; finance and insurance; educational services, and transportation and warehousing produced the slowest gains in 2017.

Some of the fastest gains in 2017 were generated by low wage industries, such as other services; agriculture, forestry, and fishing; and accommodation and food. This suggests that the increase of Arizona’s minimum wage from $8.05/hour to $10.00/hour in January 2017 may have contributed to the acceleration.

Exhibit 3: Arizona Wages Per Worker By Two-Digit NAICS Code, QCEW

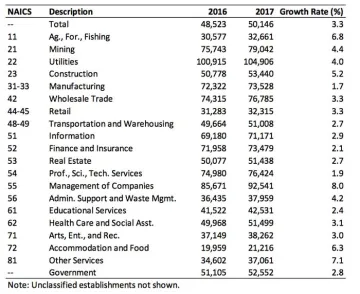

Exhibit 4 depicts gains in Arizona wages per worker for the first two quarters of 2018, compared to the same period of 2017. The quarterly data tend to be volatile (see Exhibit 1 above), so the results should be interpreted with some caution.

Overall, the exhibit shows that wage gains continued at a solid pace through the first half of 2018. Across all industries, wages rose by 3.4% during the period. Information, mining, finance and insurance, real estate, and manufacturing posted the fastest growth. On the other end of the spectrum, management of companies; educational services; transportation and warehousing; other services; and professional, scientific, and technical services posted outright declines.

Exhibit 4: Arizona Wages Per Worker By Two-Digit NAICS Code, Data Through The First Half Of 2018, QCEW