Arizona’s Economy Poised for Growth But Coronavirus Poses Risks

Arizona is carrying significant momentum into 2020, with solid job, income, and population gains last year. State growth far exceeded the nation on each of those indicators in 2019 and looks set to do so again in 2020. Labor markets continue to tighten, and that is putting upward pressure on wages. Steady population gains mean housing is in demand, but low inventories, falling mortgage rates, and rising costs are putting upward pressure on prices and driving down affordability.

Recession risks for Arizona and the U.S. have receded to normal levels during the past three months. That leaves clearing skies for continued economic expansion in 2020 and 2021. However, we will want to continue to keep an eye on developments regarding the spread of the coronavirus (and similar health issues that may impact economic activity), international trade and tariffs, and geopolitical events (like war or terrorist attacks).

Arizona Recent Developments

The Arizona labor market finished strong in 2019 according to the preliminary data. The state added 76,900 jobs over the year in the fourth quarter, for 2.6% growth. Arizona outpaced national job growth in the fourth quarter, at 1.4%. As usual, the Phoenix Metropolitan Statistical Area (MSA) generated most state job gains in the fourth quarter, with an over-the-year increase of 63,400 jobs. That translated into 2.9% growth, more than double the national rate. The Tucson MSA also generated job gains in the final three months of 2019, adding 7,600 jobs for 1.9% growth.

Arizona’s population rose at a solid pace in 2019, reaching 7,187,990 residents, according to the latest estimates from the Arizona Office of Economic Opportunity. The state added 111,791 residents from July 1, 2018 to July 1, 2019, which translated into 1.6% growth. That was the same growth rate as in 2018.

One major demographic shift during the past decade was Arizona’s baby bust. After rising at a rapid pace for many years, births to Arizona mothers collapsed beginning in 2008. Arizona births rose from 37,591 in 1970 to a high of 102,687 in 2007. After hitting that high, state births have declined during the past decade to just 80,393 in 2018, according to data from the Arizona Department of Health Services, Vital Statistics. That translated into a 21.7% decline.

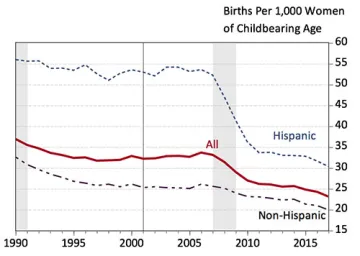

While similar trends have been observed across most states, the drop in Arizona was nonetheless striking. The primary cause was a major drop in birth rates for Hispanic women. Exhibit 1 shows trends in birth rates for Arizona women of childbearing age, broken out into three groups: total, Hispanic, and Non-Hispanic. The birth rate for Hispanic women fell from a peak of 53.6 births per 1,000 women in 2006 to 30.3 by 2017. In contrast, birth rates for Non-Hispanic women fell from 26.1 in 2006 to 19.9 in 2017.

Exhibit 1: Arizona Birth Rates for Hispanic Women Fell Dramatically During the Past Decade

Births Per 1,000 Women of Childbearing Age

For Hispanic women, the decline in birth rates was particularly dramatic for younger women. The causes of the drop in birth rates for young Hispanic women are not well understood as yet. One contributing factor may be the impact of the Great Recession on perceptions of future economic opportunity. Another cause may be cultural changes, as new generations of Hispanic women delay starting a family until after college and the start of a career.

Overall, declining births, combined with rising deaths as the baby boom generation ages, means that we can expect slower rates of natural increase in Arizona’s population going forward. One implication of this is that population change will be increasingly driven by volatile net migration flows.

Arizona house prices rose at a rapid pace in 2019. According to the all-transactions data from the Federal Housing Finance Agency (FHFA), Arizona house prices rose 5.9% over the year in the third quarter of 2019. That was faster than the national rate of 4.6%. Phoenix MSA house prices increased by 5.6% over the year, while Tucson house prices rose by 6.6%. Tucson house price increases beat the Phoenix rate for the second time so far in 2019. This reverses a trend of faster price gains in Phoenix that held from 2012 to 2018.

Keep in mind that the FHFA data tracks repeat sales on single-family homes financed by mortgages purchased or securitized by Fannie Mae or Freddie Mac. These mortgages must conform to origination balance limits required by law and so exclude some high-value mortgage transactions. FHFA data differ significantly from median house price data tracked the Multiple Listing Services (and others). These measures do not track price change for a given property over time and can be significantly influenced by the mix of properties sold during a given time period.

Arizona personal income rose by 5.4% over the year in the third quarter of 2019, beating the national pace of 4.4%. As usual, most of the increase was driven by net earnings from work (wages, fringe benefits, proprietor’s income) which increased by 5.5% over the year. Income from transfer receipts also contributed, rising 8.8% over the year. Transfer receipts include social security income, Medicare, Medicaid, and welfare. Finally, income from dividends, interest, and rent rose 1.8%. Overall, Arizona generated solid gains in income through the first three quarters of 2019.

Arizona Outlook

The Arizona forecast depends on projections for U.S. and global growth, which come from IHS Markit and were completed in January 2020.

The clouds surrounding the national outlook in recent quarters have parted, although growth is still expected to slow in coming years. Recession risks have receded to the background, for now, but will remain in the picture going forward. Overall, confidence in continued U.S. growth through 2020 and beyond has significantly increased.

Real Gross Domestic Product (GDP) is expected to rise by 2.1% in 2020 and 2021, down slightly from the 2.3% rate last year. Gains further decelerate to 1.7% in 2022 and 1.5% in 2023. Overall, the forecast calls for the above-trend growth during 2017-2019 to decelerate to below-trend growth by 2022.

Real consumption spending remains strong in the near term, rising by 2.8% in 2020 and 2.7% in 2021, before slowing to 2.3% and 2.2% in 2022 and 2023, respectively. Strong gains in wealth (equity markets and house prices) accompanied by solid income growth drive household spending forward during the forecast.

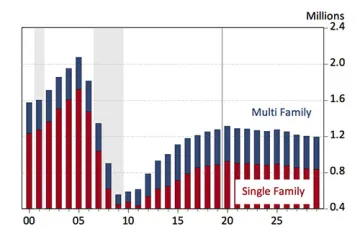

Residential construction is forecast to stabilize near 2019 levels, as demographic forces restrain gains (Exhibit 2). Total residential housing starts hit 1.27 million last year and are forecast to rise again to 1.31 million in 2020, before returning to the 1.27 million range by 2023. Demographic factors reflect the impact of slow population growth (driven by reduced natural increase and international migration) and slow household formation on demand for housing.

Exhibit 2: U.S. Residential Construction Is Forecast to Stabilize Near Current Levels

U.S. Single-Family and Multi-Family Housing Starts, IHS Markit, January 2020

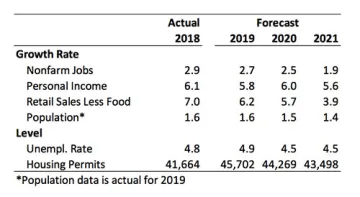

Continued, but slowing, national growth generates a similar outlook for Arizona. The forecast calls for Arizona to sustain solid job gains in 2020, after strong growth in 2019. The state is expected to add 74,700 jobs in 2020, which translates into 2.5% growth (Exhibit 3). That is more than double the expected national growth rate of 1.2%. State job growth decelerates beginning in 2021 as demographic forces take hold in Arizona (as well as nationally).

Exhibit 3: Arizona Outlook Summary

Personal income continues to rise at a solid pace during the forecast, supported by job, population, and wage gains. Tight labor markets support solid wage gains during the next decade.

Income gains drive increases in taxable retail sales in Arizona, although growth is forecast to decelerate from 7.0% in 2018 to 3.9% by 2021.

Job gains also contribute to solid net migration into Arizona, which will become an even more important source of population gains for the state. Arizona is forecast to add 106,600 new residents in 2020 for 1.5% growth. Population growth rates decline during the next decade, as demographic aging puts downward pressure on births and upward pressure on deaths.