Arizona’s Recovery: Light At the End of the Tunnel

First Quarter 2021 Forecast Update

The Arizona economy finished 2020 in better shape than most states and the recovery continues at a solid pace. However, Arizona job growth lost momentum in December, according to the preliminary data. While state jobs were 3.0% below their February peak, that represented a huge 90,100 job gap. Over half of the job gap was in leisure and hospitality, as the travel and tourism industry remained hard hit by the pandemic. Further, in December, all major employment sectors, with the exception of transportation and warehousing, were below their peak. Income growth in the state surged in the second and third quarters of 2020, driven upward by a gigantic flow of federal relief funds into the state that helped to stabilize the economy in general and spurred gains in retail sales of tangible goods and trade, transportation, and warehousing jobs in particular.

Uncertainty is still a key feature of the outlook. Assuming continued improvement in vaccine distribution through 2021, the state should regain momentum as the year progresses. The baseline forecast calls for state jobs to regain their pre-pandemic peak in the third quarter of 2021. The travel and tourism sector will likely take longer to rebound, but will eventually recover. If vaccine distribution progresses more slowly than envisioned under the baseline, or if the evolution of the virus renders current vaccines significantly less effective, the recovery will be delayed.

Arizona Recent Developments

As of December 2020, Arizona jobs remained 90,100 below the peak in February, according to the preliminary estimates. As Exhibit 1 shows, Arizona’s leisure and hospitality jobs were the hardest hit in December, accounting for just over half of the job gap since February. Professional and business services; government; and education and health services also remain far below February. Keep in mind that nearly all major sectors of the state economy are still below their February level.

Trade, transportation, and utilities jobs were 19,100 above their February level. This reflected strong gains in transportation and warehousing, as well as trade. These sectors were boosted by the huge infusion of federal funds through the CARES Act, re-directed demand from travel and tourism, as well as accelerating trends favoring online shopping and delivery.

Exhibit 1: Arizona Leisure and Hospitality Jobs Remained the Hardest Hit in December

Change in Nonfarm Jobs (Thousands, Seasonally Adjusted) and Wages per Worker

| Industry | Job Change: February-December 2020 | Annual Wage 2019 |

| Leisure and Hospitality | -46.6 | $25,557 |

| Professional and Business Services | -21.3 | $58,892 |

| Government | -14.9 | $55,696 |

| Education and Health Services | -10.1 | $52,632 |

| Manufacturing | -5.9 | $78,966 |

| Information | -4.4 | $77,822 |

| Construction | -4.3 | $58,621 |

| Financial Activities | -1.5 | $74,627 |

| Natural Resources and Mining | -0.4 | $52,262 |

| Other Services | 0.2 | $39,965 |

| Trade, Transportation, and Utilities | 19.1 | $48,023 |

| Total Nonfarm Jobs | -90.1 | $53,807 |

| Source: Bureau of Labor Statistics |

Arizona’s recovery has not been evenly spread across the state’s metropolitan areas. In December, Flagstaff was the furthest below its February peak, with jobs down 15.4%. Jobs were down 9.0% in Yuma, 3.8% in Lake Havasu City-Kingman, and 1.2% in Sierra Vista-Douglas. Jobs in the Prescott MSA have been close to the February peak since October.

Further, since June, most metropolitan areas in Arizona have struggled to generate job growth. The exception was the Phoenix MSA, which accounted for all of the state’s net job gains.

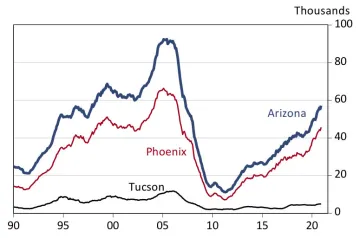

While construction jobs ended the year below their February level, at least according to the preliminary data, housing permits and house prices surged ahead. Exhibit 2 shows that housing permits for Arizona, Phoenix, and Tucson are at the highest level in more than a decade.

Arizona total housing permits rose by 23.0% in 2020 to 57,281. That was up from the revised 2019 annual total of 46,580. Most of the increase was driven by single-family activity, which rose to 41,465. That was an increase of 22.0%. Multi-family permits rose by 25.5% to 15,816 in 2020.

Phoenix MSA housing permits increased to 45,694 in 2020, an increase of 27.4%. Single-family permits increased to 31,475 (up 25.8%) and multi-family permits rose to 14,219 (up 31.1%).

Tucson MSA housing permits also increased last year, but at a slower pace. Total permits rose by 14.9% to hit 4,956. Single-family permits accounted for all of the increase, rising by 21.6%. Multi-family permits dropped by 13.3% in 2020.

The house prices indexes from the Federal Housing Finance Agency (FHFA) measure repeat sales on single-family homes, and thus are not impacted by composition effects that can distort trends in median house prices. Data for the third quarter of 2020 also indicate strong house price appreciation in Arizona, with prices up 7.9% over the year statewide, 8.3% in Phoenix, and 7.2% in Tucson. Nationally, house prices were up 4.7% over the year in the third quarter.

Exhibit 2: Arizona Housing Permits Surge Ahead in 2020

Twelve-Month Lagged Moving Average, Annualized

While jobs took a big hit during 2020, personal income growth skyrocketed. This paradoxical result was driven by federal fiscal action, primarily the CARES Act. According to the U.S. Bureau of Economic Analysis (BEA) state personal income rose by 13.4% over the year in the second quarter of 2020 and by 9.7% in the third quarter.

Transfer receipts, primarily those related to the CARES Act, that drove the increase in personal income in the second and third quarters. Transfer receipts rose by 67.1% over the year in the second quarter and by 35.4% in the third quarter.

Arizona Outlook

The forecast for Arizona depends on global and national economic performance. The current state and local forecasts rely on the January 2021 U.S. forecast generated by IHS Markit, which was based on the following assumptions:

COVID-19 infections and deaths remain elevated until a vaccine is widely available in mid-2021.

The forecast includes the omnibus spending bill enacted on December 27 and the Coronavirus Relief and Recovery Supplemental Appropriations Act of 2020, but not the Biden relief plan.

The Federal Reserve maintains its policy rate near 0% until late 2026. The Federal Reserve is assumed to tolerate inflation modestly above 2.0% after 2026.

Real foreign GDP contracts by 5.7% in 2020. Growth rebounds to 4.3% in 2021.

The baseline forecast calls for U.S. real GDP to decline by 3.6% in 2020, then to recover with gains of 4.0% in 2021 and 3.9% in 2022.

Nonfarm payroll jobs nationally drop by 5.8% in 2020, but rebound in 2021 with growth of 3.0%. Jobs rise strongly again in 2022 with growth of 3.3%.

The unemployment rate peaks at 8.1% for the year in 2020, then declines to 5.2% in 2021 and 3.9% in 2022.

Inflation gathers modest momentum during the near term, with average price increases of 2.1% in 2021 and 2.5% in 2022.

The U.S. and global outlook sets the stage for a solid recovery in Arizona (Exhibit 3). The baseline forecast (50% probability) calls for state jobs to regain the first quarter 2020 peak in the third quarter of 2021. On an annual average basis, job growth rebounds from a 2.3% decline in 2020 into a 4.0% increase in 2021 and 2022.

The largest job gains during the 2020 to 2022 period are expected to come in leisure and hospitality; professional and business services; trade, transportation, and utilities; and education hand health services. These four sectors are forecast to generate three quarters of total net job growth.

Job growth in the Phoenix MSA is forecast to hit 3.8% in 2021 and 3.6% in 2020, after a 2.0% decline in 2020. The Tucson MSA is forecast to generate job growth of 3.2% in 2021 and 2.7% in 2022, after a 2.9% decline in 2020.

The forecast calls for personal income growth to decelerate from 8.2% in 2020 to 3.5% in 2021 and 2022. That reflects a fairly smooth transition from federal funding as the main support for growth to more normal economic activity.

The forecast calls for population growth to accelerate modestly in 2021 and 2022, reflecting increased net migration which is weighed down by weakening natural increase. Net population change is forecast to be 116,000 in 2021 and 121,300 in 2022. Net migration in 2021 and 2022 is expected to reach its highest level since 2006 as the state’s solid job growth and housing affordability draws increased migration from other states.

Exhibit 3: Arizona Outlook Summary

| Forecast | |||||

| 2020 | 2021 | 2022 | 2023 | ||

| Growth Rate | |||||

| Nonfarm Jobs | -2.3 | 4.0 | 4.0 | 2.2 | |

| Personal Income | 8.2 | 3.5 | 3.5 | 5.9 | |

| Retail Plus Remote Sales | 13.5 | 4.7 | 3.9 | 4.2 | |

| Population | 1.5 | 1.6 | 1.6 | 1.4 | |

| Level | |||||

| Unempl. Rate | 7.8 | 5.1 | 4.1 | 4.3 | |

| Housing Permits | 57,174 | 52,098 | 49,640 | 45,937 | |

| Source: EBRC. Personal income and retail sales are forecast in 2020. | |||||